Homeowners Insurance in and around Madison

Looking for homeowners insurance in Madison?

The key to great homeowners insurance.

Would you like to create a personalized homeowners quote?

Home Is Where Your Heart Is

Committing to homeownership is an exciting time. You need to consider home layout cosmetic fixes and more. But once you find the perfect place to call home, you also need excellent insurance. Finding the right coverage can help your Madison home be a sweet place to be.

Looking for homeowners insurance in Madison?

The key to great homeowners insurance.

Why Homeowners In Madison Choose State Farm

You’ll get that and more with State Farm homeowner’s insurance. State Farm has coverage options to keep your home and everything in it safe. You’ll get a policy that’s personalized to correspond with your specific needs. Luckily you won’t have to figure that out on your own. With empathy and fantastic customer service, Agent Alejandra Bustamante can walk you through every step to build a policy that protects your home and everything you’ve invested in.

Terrific homeowners insurance is not hard to come by at State Farm. Before the unforeseeable transpires, visit agent Alejandra Bustamante's office to help you get the home coverage you need.

Have More Questions About Homeowners Insurance?

Call Alejandra at (608) 249-4718 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Pros and cons of metal roofs for your home

Pros and cons of metal roofs for your home

The benefits of a metal roof may outweigh traditional asphalt shingles, especially when you consider a metal roof lifespan.

How to get rid of nuisance deer

How to get rid of nuisance deer

Nuisance deer can cause major property damage. Learn tips for deterring deer, such as using repellents, fencing, scare tactics, and deer resistant plants.

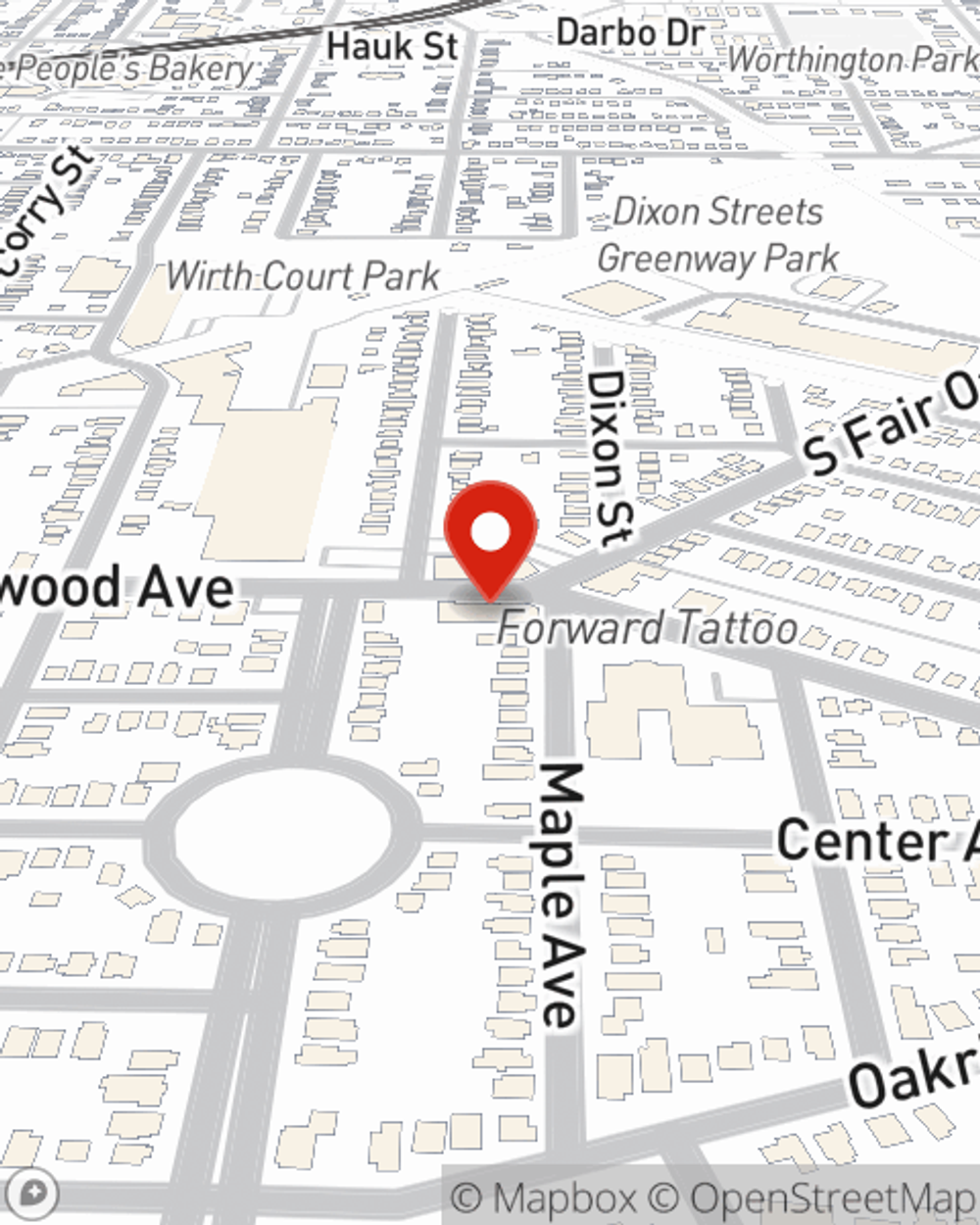

Alejandra Bustamante

State Farm® Insurance AgentSimple Insights®

Pros and cons of metal roofs for your home

Pros and cons of metal roofs for your home

The benefits of a metal roof may outweigh traditional asphalt shingles, especially when you consider a metal roof lifespan.

How to get rid of nuisance deer

How to get rid of nuisance deer

Nuisance deer can cause major property damage. Learn tips for deterring deer, such as using repellents, fencing, scare tactics, and deer resistant plants.